在FRM一级考试中,Hedging Using Futures Contract是其中内容之一。备考中的考生要对其内容有所了解。下文是小编为你介绍的相关内容,一起了解一下!

Short Hedges:

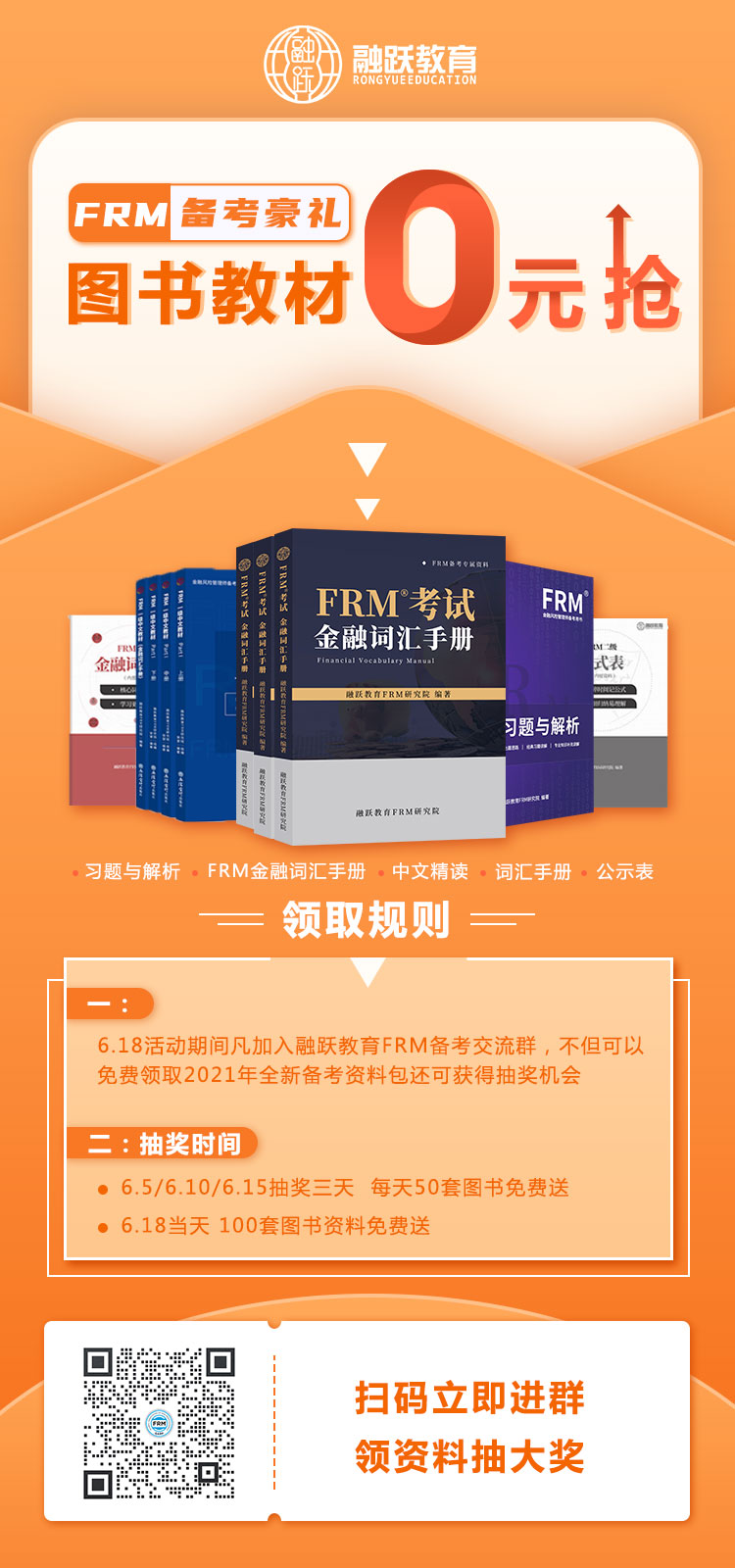

A short position in futures contracts;》》》2021年新版FRM一二级内部资料免费领取!【精华版】

Appropriate when the hedger already owns anasset and expects to sell it at some time in thefuture;

Long Hedges: ž

A long position in a futures contract;

Appropriate when a company knows it will have to purchase a certain asset in the future and wants to lock in a price now;

Arguments for hedging:

Reduce price risk;

Less uncertainty;

Arguments against hedging:》》》融跃教育618抢先购——千元礼包1元购

less profitability;

shareholders can easily hedge risk;

nature of the hedging company’s industry;

Basis Concept:

Basis=SP-FP;

Basis =0 at maturity;

spot price increases faster(slower) than the futures price over the hedging horizon, basis increases(decreases);

Problems give rise to basis risk:【资料下载】点击下载FRM二级思维导图PDF版

The asset whose price is to be hedged may not be exactly the same as the asset underlying the futures contract;

There may be uncertainty as to the exact date when the asset will be bought or sold;

The hedge may require the futures contract to be closed out before its delivery month;

FRM考试的内容就分享这么多,学员如果还有更多的内容想要学习,可以在线咨询老师或者添加老师微信(rongyuejiaoyu)。