备考FRM二级考试中,考生对于知识的记忆用思维导图对于考生是很方便的。Introduction of Credit Risk是信用风险管理与测量的内容,下面小编为大家用思维导图的方式为大家介绍一下相关知识,希望对备考的你有所帮助!

一、Credit Decision and Credit Analyst

1、Four primary components of credit risk evaluation:

The borrower’s capacity and willingness to repay the loan

The external environment

The characteristics of the credit instrument

The quality and adequacy of risk mitigants》》》点击领取2021年FRM备考资料大礼包(戳我免费领取)

2、Qualitative credit analysis:

Gather information

Face to face meetings

"Name lending"

Inferring past performance into the future

3、Quantitative credit analysis:》》》点我咨询21年FRM备考技巧

financial statements

二、Capital Structure in Banks

1、Credit Risk Factors

Probability of Default (PD)

Exposure Amount (EA)

Loss Rate (LR)

2、Expected loss (EL)

ELt=PDt*EAt*LRt

3、Unexpected losses (UL)

UL=VaR-EL

4、Portfolio Expected and Unexpected Loss【资料下载】点击下载融跃教育FRM考试公式表

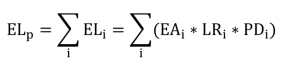

Expected loss of portfolio is the sum of expected loss of each asset

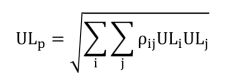

portfolio unexpected loss (ULp)

希望以上的内容对你有帮助,如果您想了解更多FRM考试相关问题,点击在线咨询或者添加融跃FRM老师微信(rongyuejiaoyu),给您专业的指导帮助!