在FRM考试中,考生需要记忆的内容有很多,比如Quantifying volatility in VaR models。下文是对Quantifying volatility in VaR models内容的详细介绍,一起了解一下!

Deviations from normality:

Normal returns;

Symmetrical distribution——“Normal” Tails——Stable distribution》2022年新版FRM一二级内部资料免费领取!【精华版】

Actual financial returns;

Skewed——Fat-tailed (leptokurtosis)——Time-varying parameters

Fat tails & Regime-switching volatility model:

Existence of fat tails;

A distribution is unconditional if tomorrow’s distribution is the same as today’s distribution.

But fat tails could be explained by a conditional distribution: a distribution that changes over time.

Regime-switching volatility model:

the regime (state) switches from low to high volatility, but is never in between.

a risk manager may assume (and measure) an unconditional volatility but the distribution is actually regime switching.

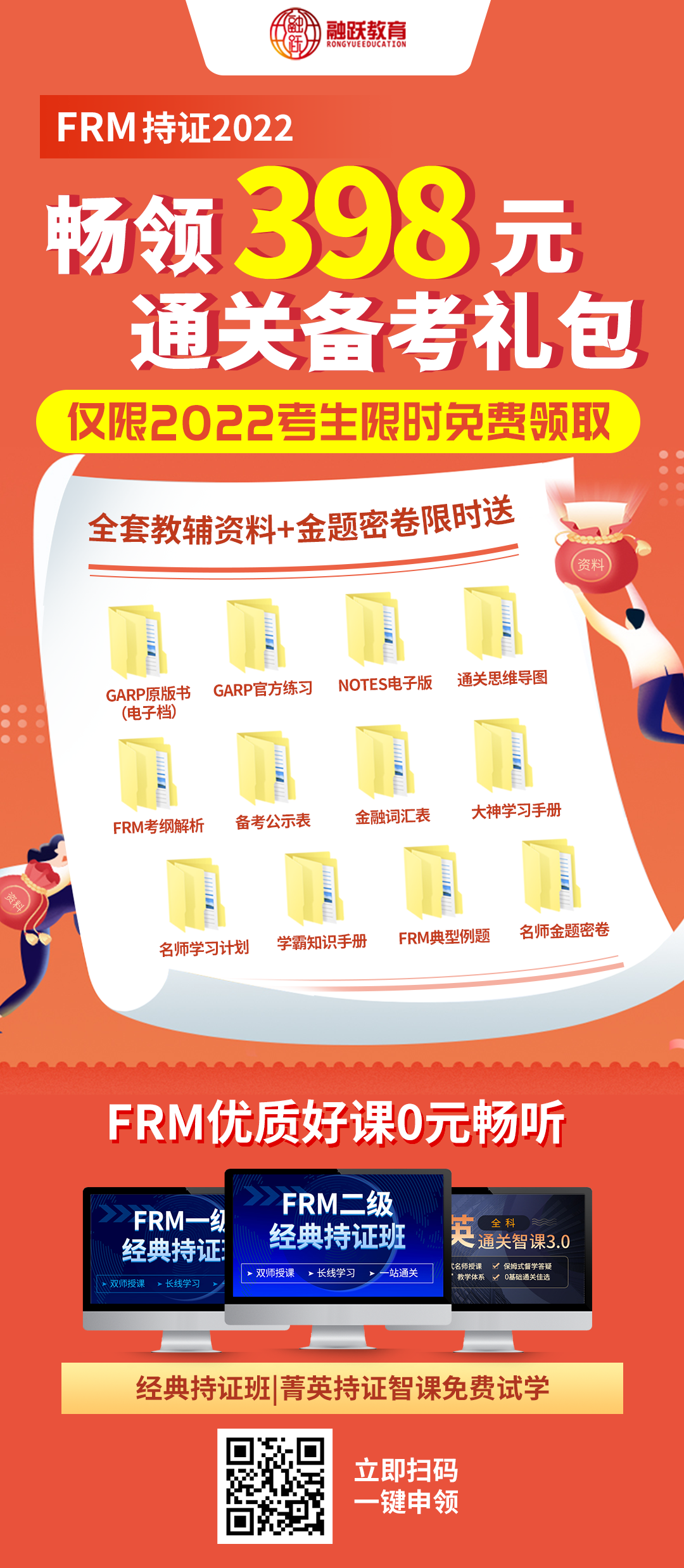

想要了解更多有关FRM考试相关知识点的内容,可以在线咨询或添加融跃老师微信(rongyuejiaoyu),免费领取融跃教育金融专业英语词汇大全!