现在5月FRM考试早鸟价报名中,报名后,考生除了要认真学习网课,还需要做大量的真题,这对于通过考试是很有帮助的,下面是小编列举的相关真题,送给广大考生!

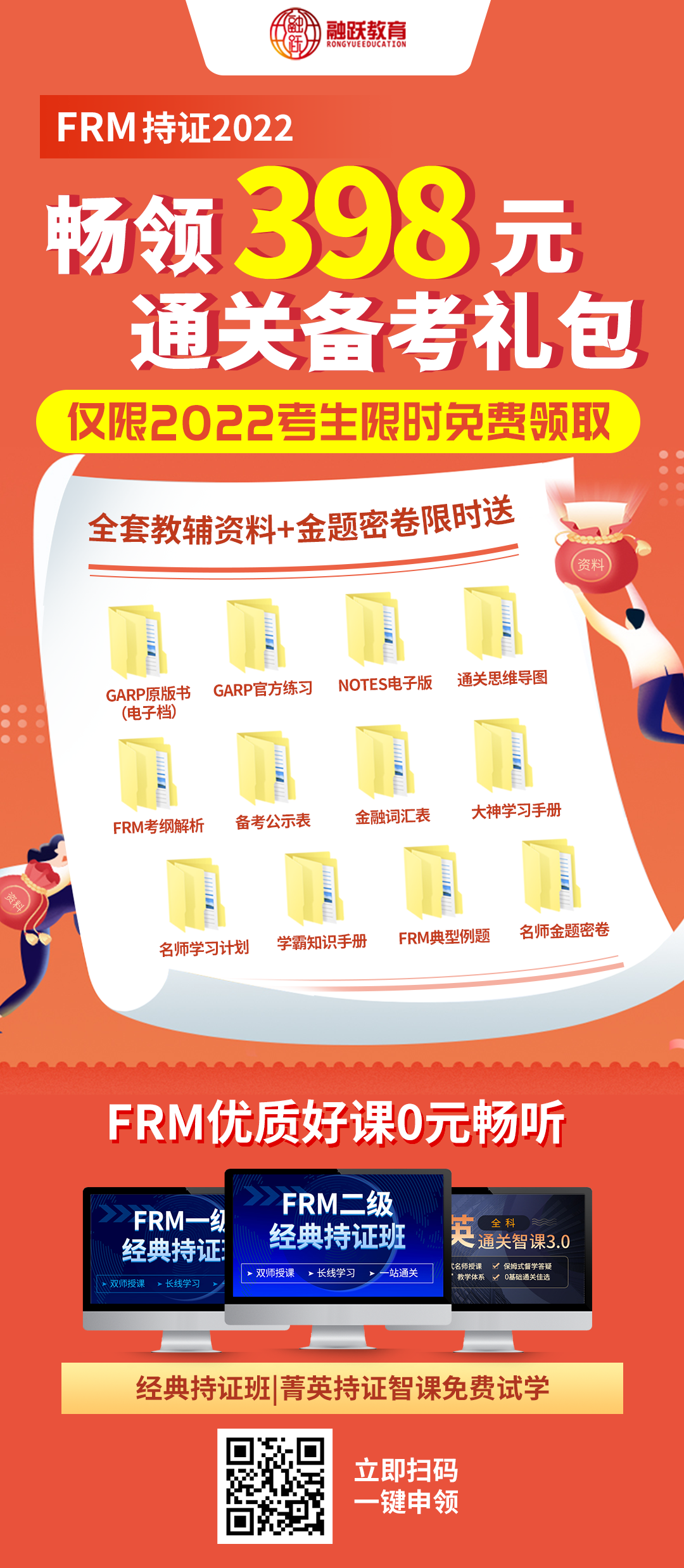

Which of the following risks are not related to operational risk?》2022年新版FRM一二级内部资料免费领取!【精华版】

A) Errors in trade entry

B) Fluctuation in market prices

C) Errors in preparing MasterAgreement

D) Late confirmation

答案:B

解析:Operational risks arise from human and technological errors or accidents associated with running a business. Operational risks pertain to losses due to inadequate systems, management and human errors, faulty controls, and fraud. Market price volatility is a market risk.

The difference between bottom-up methods for measuring operational risk and top-down methods for measuring operational risk is that bottom-up methods focus on:

A) Loss causes rather than just loss indicators.

B) Quantitative rather than qualitative measures of risk.

C) Loss indicators rather than just loss causes.

D) Qualitative rather than quantitative measures of risk.

答案:A

解析: The bottom-up difference is that the focus is on loss causes rather than just loss indicators. Bottom-up operational risk measures may be either quantitative or qualitative.

Capital is used to protect the bank from which of the following risks:

A) Risks with an extreme financial impact.

B) High frequency low loss events.

C) Low frequency risks with significant financial impact.

D) High frequency uncorrelated events.

答案:C

解析: Low-frequency, high-severity risks will create the largest unexpected losses and, therefore, require risk capital to prevent losses.

如果想要获得更多关于FRM考试的真题解析,点击在线咨询或者添加融跃老师微信(rongyuejiaoyu)!