备考FRM的考生都知道FRM真题练习的重要性,尤其是在备考冲刺阶段,考生一定要相应的练习!那么,FRM真题练习有例题解析吗?看下文小编列举的相关解析!

If the one-day value at risk (VaR) of a portfolio is $50,000 at a 95% probability level, this means that we should expect that in one day out of:》》》戳:免费领取FRM各科视频讲义+历年真题+21年原版书(PDF版)

A) 20 days, the portfolio will decline by $50,000 or less.

B) 95 days, the portfolio will lose $50,000.

C) 95 days, the portfolio will increase by $50,000 or more.

D) 20 days, the portfolio will decline by $50,000 or more.

答案:D

解析:A95% one-day portfolio value at risk (VaR) of $50,000 means that in 5 out

of 100 (or one out of 20) days, the value of the portfolio will experience a

loss of $50,000 or more.

Conditional VaR is best described as the:

A) Loss conditional on specific economic conditions.

B) Loss conditional on specific market conditions.

C) Average loss given that losses exceed the VaR.

D) Loss if new assets are added to the portfolio.

答案:C

解析:The Conditional VaR is the average of the losses that exceed the pre-specified worst case return, which for example may be the pre-specified VaR. 【资料下载】点击下载GARP官方FRM二级练习题

Aportfolio manager determines that his portfolio has an expected return of $20,000 and a standard deviation of $45,000. Given a 95 percent confidence level, what is the portfolio's VaR?

A) $43,500.

B) $74,250.

C) $94,250.

D) $54,250.

答案:D

解析:|20,000–45,000*1.65| = 54,250

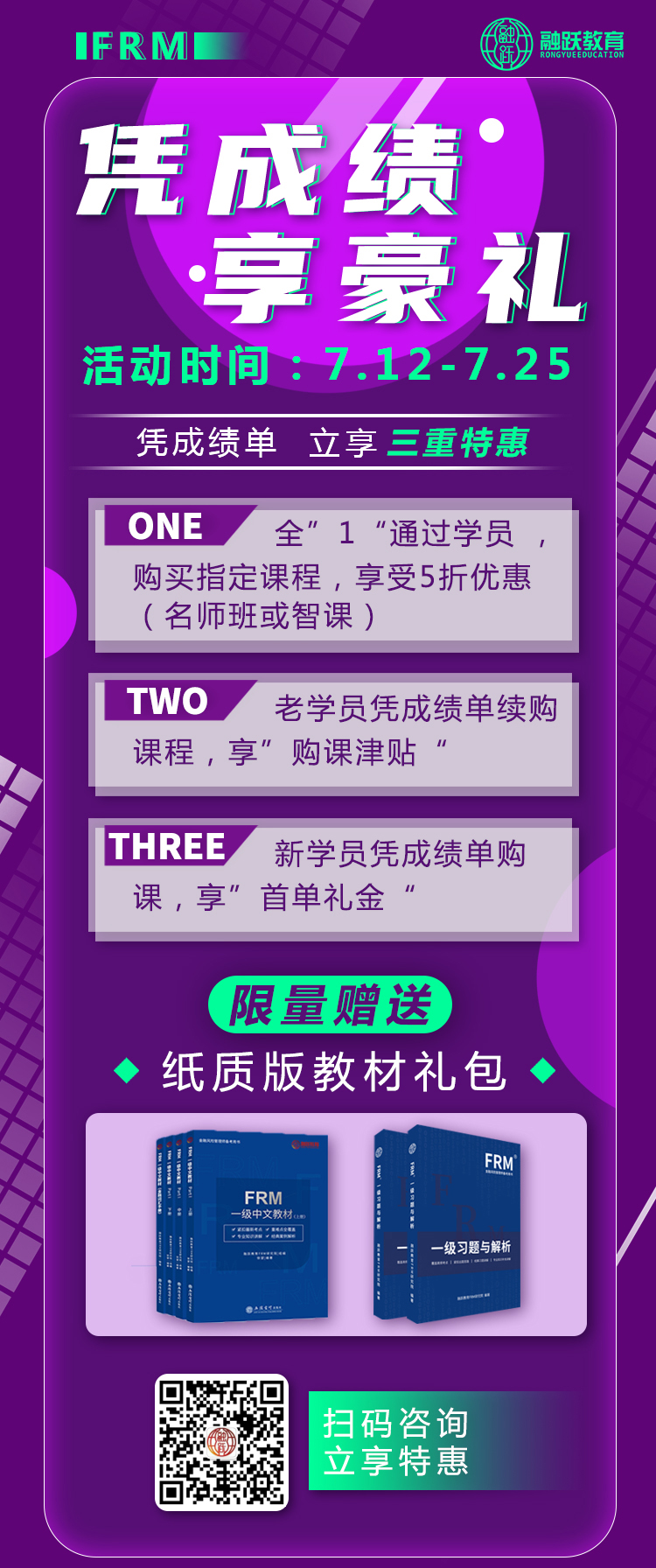

如果想要获得更多关于FRM考试的真题解析,点击在线咨询或者添加融跃老师微信(rongyuejiaoyu)!