FRM真题在备考中是很重要的,广大考生一定要认真对待,下文是介绍的相关真题解析,希望对备考的你有所帮助!

In fixed income portfolio mapping, when the risk factors have been selected, which of the following mapping approaches requires that one risk factor be chosen that corresponds to average portfolio maturity?

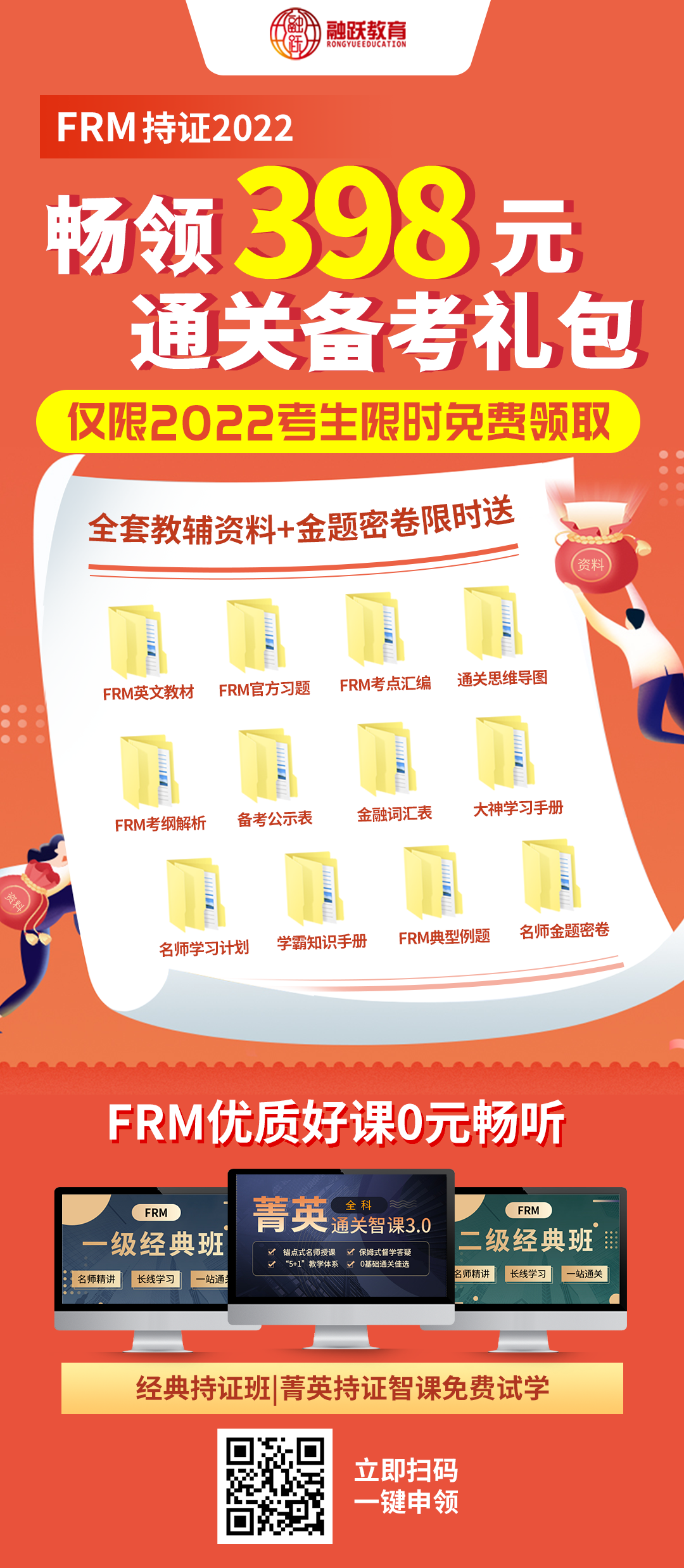

》》》2022年新版FRM一二级内部资料免费领取!【精华版】

A) Principal mapping

B) Duration mapping

C) Convexity mapping

D) Cash mapping

答案:A

解析:With principal mapping, one risk factor is chosen that corresponds to the average portfolio maturity. With duration mapping, one risk factor is chosen that corresponds to the portfolio duration. With cash flow mapping, the portfolio cash flows are grouped into maturity buckets. Convexity mapping is not a method of VaR mapping for fixed income portfolios.

Computing VaR on a portfolio containing a very large number of positions can be simplified by mapping these positions to a smaller number of elementary risk factors. Which of the following mappings would be adequate?

A) USD/EUR forward contracts are mapped on the USD/JPY spot exchange rate.

B) Each position in a corporate bond portfolio is mapped on the bond with the closest maturity among a set of government bonds.

C) Government bonds paying regular coupons are mapped on zero-coupon

government bonds.

D) Aposition in the stock market index is mapped on a position in a stock within that index.

答案:C

解析:Mapping government bonds paying regular coupons onto zero coupon government bonds is an adequate process, because both categories of bonds are government issued and therefore have a very similar sensitivity to risk factors.

However, this is not a perfect mapping since the sensitivity of both classes of bonds to specific risk factors (i.e., changes in interest rates) may differ.

如果想要获得更多关于FRM考试的真题解析,点击在线咨询或者添加融跃老师微信(rongyuejiaoyu)!