FRM考试真题练习对于考生重要吗?这是近几天收到考生问的最多的问题,关于这个答案,小编告诉你,关于真题的练习是很有必要的,尤其是考试冲刺阶段,一定要多做近几年的真题练习!下面是小编列举的相关真题,希望对你有所帮助!

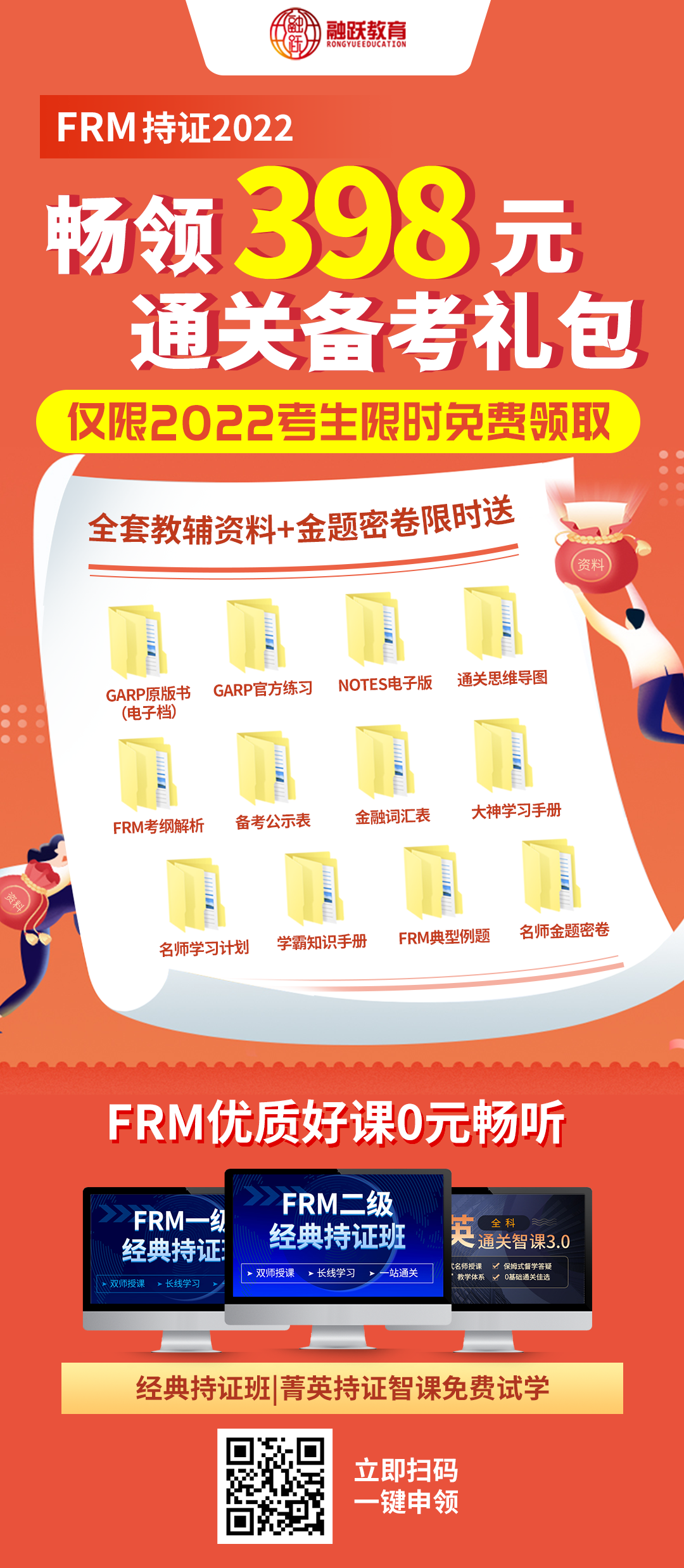

Under the basic indicator approach (BIA), what is Alpha Bank's capital charge if it has revenues of $100 million, $150 million, and $200 million in the first three years?》2022年新版FRM一二级内部资料免费领取!【精华版】

A) $22.0 million.

B) $22.5 million.

C) $23.0 million.

D) $23.5 million.

答案:B

解析:The BIA is based on 15% of the bank’s annual gross income over a three-year period and is computed as follows: KBIA=(100+150+200)/3x0.15=$22.5milllion

In setting the threshold in the POT approach, which of the following statements is the most accurate? Setting the threshold relatively high makes the model:

A) Less applicable but increases the number of observations in the modeling procedure.

B) Less applicable and decreases the number of observations in the modeling procedure.

C) More applicable but decreases the number of observations in the modeling procedure.

D) More applicable but increases the number of observations in the modeling

procedure.

答案:C

解析:There is a trade-off in setting the threshold. It must be high enough for the appropriate theorems to hold, but if set too high; there will not be enough observations to estimate the parameters.

The peaks-over-threshold approach generally requires:

A) More estimated parameters than the GEV approach and shares one parameter with the GEV

B) Fewer estimated parameters than the GEV approach and shares one parameter with the GEV

C) More estimated parameters than the GEV approach and does not share any parameters with the GEV approach.

D) Fewer estimated parameters than the GEV approach and does not share any parameters with the GEV approach.

答案:B

解析:The POT approach generally has fewer parameters, but both POT and GEV approaches share the shape parameterξ. Typical financial data haveξ>0, which implies fat tails.

如果想要获得更多关于FRM考试的真题解析,点击在线咨询或者添加融跃老师微信(rongyue857)!