在备考FRM考试中,考生一定要做大量的真题,尤其是近几年的真题,这对于备考是很有必要的。那么,哪里有FRM例题解析呢?

下面是小编为大家列举的相关真题解析,如果想要获得更多的FRM真题解析,可以联系在线客服哦!

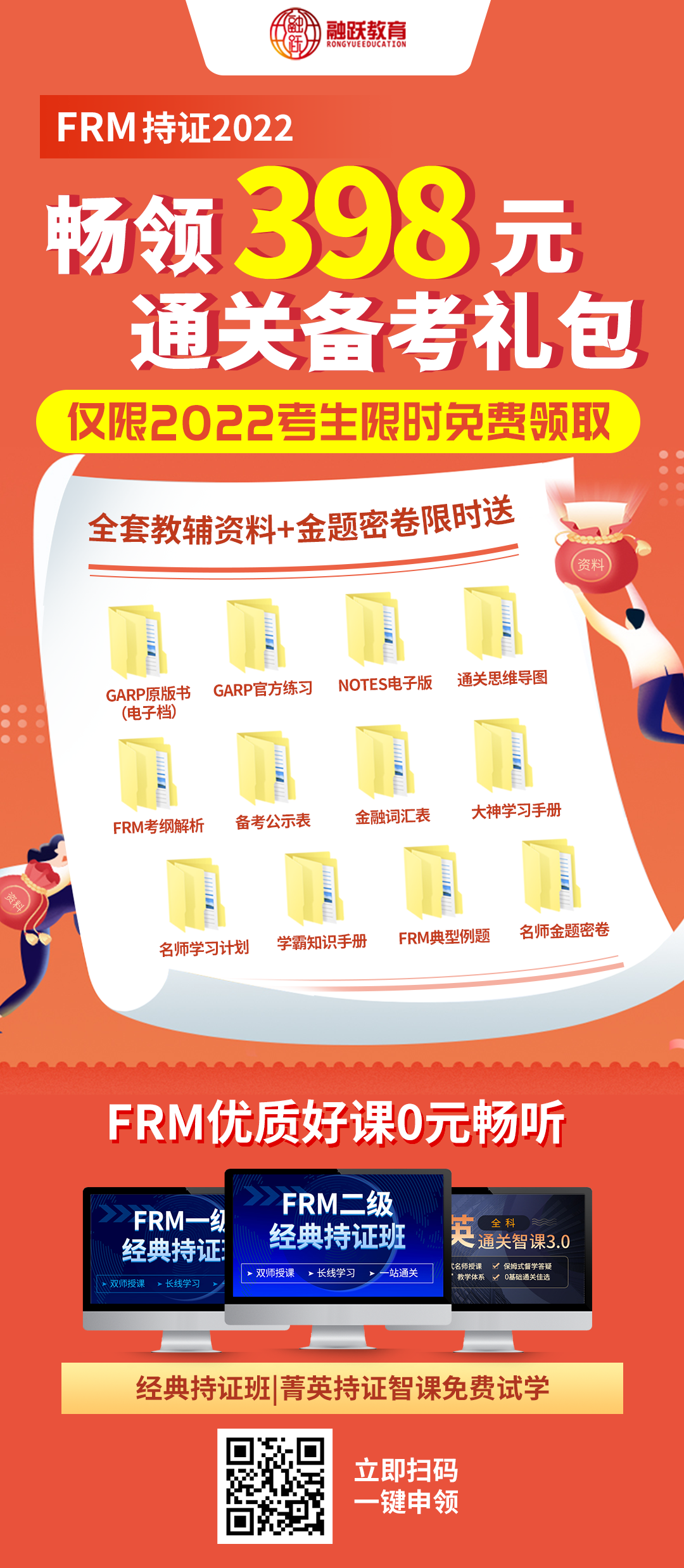

Which of the following is an example of an operational risk loss by FirmA?》2022年新版FRM一二级内部资料免费领取!【精华版】

A) After a surprise announcement by the central bank that interest rates would increase, bond prices fall, and FirmA incurs a significant loss on its bond portfolio.

B) The data capture system of Firm Afails to capture the correct market rates causing derivative trades to be done at incorrect prices, leading to significant losses.

C) As a result of an increase in commodity prices, the share price of a company that Firm Ainvested in falls significantly causing major investment losses.

D) Acounterparty of Firm Afails to settle their debt to Firm A, and in doing

this, they are in breach of a legal agreement to pay for services rendered.

答案:B

解析:systems failure or incorrect systems caused the problem. The losses are directly due to an operational risk exposure, (A) and (C), an increase in interest rates and the fall in the value of an investment, are both examples of market risk exposure, (D), failure to repay debt, is an example of credit risk exposure.

According to Basel Accord,operational risk is:

I. All the risks that are not currently captured under Market and Credit Risk.

II. The potential for losses due to a failure in the operational processes or in the systems that support them.

III. The risk of losses due to a failure in people, process, technology(system) or due to external events.

A) III only

B) II only

C) II and III only

D) I, II, and III

答案:A

解析:The Basel Committee on Banking Supervision defines operational risk as "the risk of loss resulting from inadequate or failed internal processes,people and systems or from external events." The committee states that the definition excludes strategic and reputational risks but includes legal risks.

想要了解更多有关FRM考试相关资讯,在线咨询老师或者添加融跃老师微信(rongyuejiaoyu)!另外还可以领取免费备考资料哦!